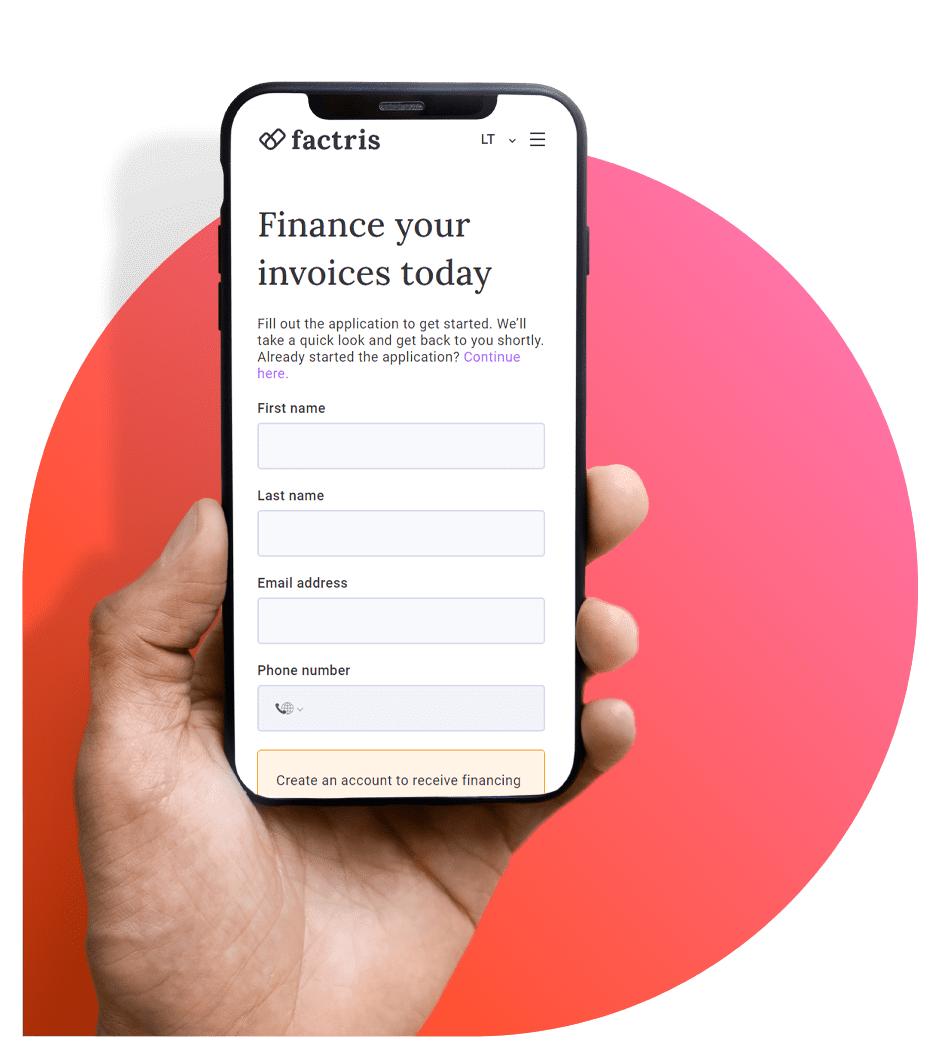

Factris’ mission is to empower SMEs through financial technology with personalised guidance.

Since 2017, Factris has chosen to do things differently.

We’ve made financing more accessible.

We’ve helped people improve what they do best.

While creating technology to be free of tiresome, tedious tasks.

We’ve said “yes” when so many have said “no”.

We’ve opened doors to funding opportunities for countless SMEs.

We’ve created a local presence across the EU.

And we’ve only gotten started.

What has Factris accomplished?

What has Factris accomplished?

Past

- Founded in Q2 2017

- Seed round led by Speedinvest

- Launch of proprietary platform FAB

- Acquisition of DEBIFO

- Opening of Factris LV1

- EUR 1.4M EU grant received for tech enhancements

- Dutch portfolio acquisition

- EUR 5.0M Series A round led by AB Ventures

- Opening of Factris PL1

- Opening of Factris BE1

- EUR 50M funding line from Aegon Asset Management

Present

- “Unlimited” funding via SPV structure by GSAM

- > EUR 1B receivables financed to-date

- Centralized payment infrastructure by ING

- Application for Factris DE1 Bafin license

- 1870+ customer success cases

Future

- EUR 1B receivables financed

- Multiple portfolio acquisitions

- Platform to Platform integrations

- Opening Factris DE1 & BE1

- Banking partnerships & integrations

The Key Components of Factris

Technology

Funding

Risk Management

Shared Services

The Human Touch

Awards

The Factris Team leading financing into the future.

Advisory board

Brian Reaves

Chief Executive Officer

Rob Oudman

Managing Director and Head of the Benelux at Houlihan Lokey

Dr. Tom F. Lesche

Faisal Hakki

Factoring isn’t just for SMEs—it’s for investors too.

Since 2015, factoring has seen 7.8% average market growth

year-on-year in countries across the EU.

Factris is leading the factoring charge, providing consistent returns for our investors.

Join the future of financing as a Factris partner.

Technology and expertise that are second to none.

Resources and support available throughout the EU.

Learn what Factris is achieving in finance

Most Innovative SME Factoring Specialists 2023 – Europe

Acquisition International is Proud to Announce the Winners of the 2023 Business Excellence Awards, and Factris is among them. Leading B2B publication, Acquisition International, has launched the 2023 edition of the Business Excellence Awards. Now in its ninth year,...

Fintech Factris Lands €50 Million For SME Lending From Aegon AM

The Amsterdam-based fintech secured a 50 million EUR funding line from Aegon Asset Management This funding line adds certainty for SMEs in an uncertain macroeconomic environment Having just reached the milestone of financing €1 billion in invoices in Q1 of 2023, the...

Fintech Factris reaches €1 billion in financing after meteoric 2022 results

The Dutch fintech finished 2022 with record-setting financing results in five EU countries Their 2022 momentum led to surpassing the €1 Billion mark In financing in Q1 of 2023 Amsterdam-based Factris closed out 2022, surpassing expectations thanks to a year-end report...

Factris named SME Financing Specialists of the Year 2023

Factris Holding B.V. was recognized in the 2023 Corporate Excellence Awards and received an SME Financing Specialists of the Year award - Europe from Corporate Vision digital magazine. Corporate Vision is published monthly on a digital platform with the mission to...